The Facts

Fuel prices rose sharply after Saudi Arabia and other OPEC+ countries announced a surprise round of output cuts on Sunday. The 1.16M barrel-per-day ("bpd") cuts could potentially spell trouble for global inflation, which was slowing down just days after an optimistic report on US price data.

According to an official with the Saudi Ministry of Energy, Saudi Arabia will begin its planned production cuts in May. The cuts will last through the end of the year.

The Spin

Pro-establishment narrative

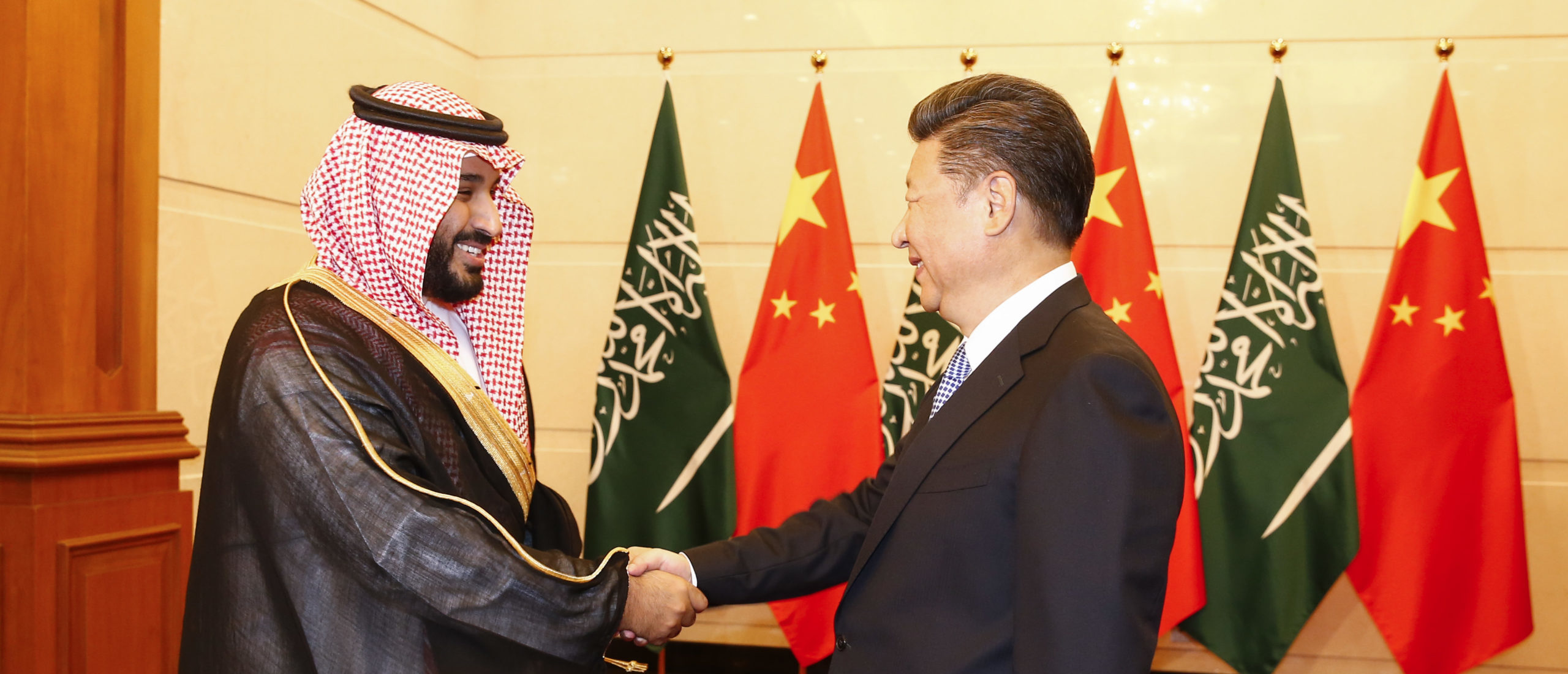

The surprise cuts by OPEC+ are ill-advised, as the decision comes just as markets and inflation are recovering. Tensions between the US and Saudi Arabia have been strained since last year when the kingdom refused to pump more. US-Saudi relations will only deteriorate further so long as OPEC+ continues this trend.

Establishment-critical narrative

Saudi Arabia was looking to offer the US a 500K barrel-per-day deal, but Washington said no. The problem here is simple, and it all lies at the feet of the US government. If America doesn't want to drill its oil in the name of transitioning to green energy, then it shouldn't be mad when OPEC+ does the same thing.