The Facts

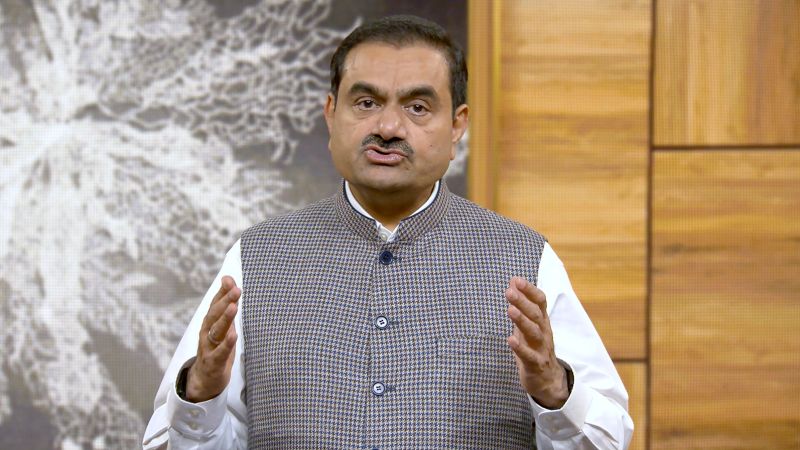

As Indian conglomerate Adani Group's market losses top $110B, dozens of India's opposition party members on Monday were detained during protests — prompting parliament to be suspended again due to disruptions surrounding the company.

The losses, which are up from $65B a week ago, follow a report by US short-seller Hindenburg Research last week, which flagged concerns about Adani firms' alleged mounting debts, stock manipulation, improper use of tax havens, and money laundering.

The Spin

Pro-establishment narrative

Despite these market trends, the Indian market remains stable and reliable. Gautam Adani has said he will refund investor losses, and the government's independent regulators are already evaluating the situation. If India's economy was in the trouble, it wouldn't be projected to grow 7% in the next year — the largest projection among all major economies.

Establishment-critical narrative

Prime Minister Modi has been quiet on this issue because he knows he's complicit. His own regulators should not be investigating this matter, but as the members of parliament have called for, a truly independent probe by the Supreme Court should be conducted. India's stock market isn't falling due to some malicious attack by Hindenburg, but because Adani's corporate-government corruption has finally been exposed.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MNAIVKLOUNPG3JAQLFH2LGKGV4.jpg)